The professional risk management software for analyses, evaluation and controlling of risks

Steps of a modern risk management software

OMNITRACKER Risk Management is a software tool which enables you to deal with risks in a uniformly structured and professional manner throughout your whole company. You will systematically perform the following steps:

- Identification & listing of all risks, regardless of their source

- Categorization of individual risks according to individually definable categories

- Evaluation of all collected risks according to type, probability of occurrence and impact. These evaluations result in a prioritization.

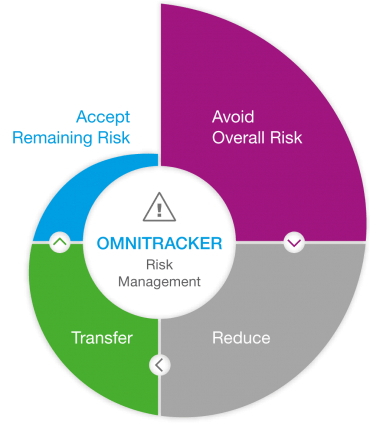

- Definition of risk strategies (avoid, reduce, transfer, accept)

- Initiate actions against identified risks with the aim of minimizing the negative effects and their probability of occurrence

- Monitoring, reporting & documentation of all risks according to pre-defined criteria

This recurring process is supposed to make a company more resistant to unexpected events, especially in form of risks. A modern, intelligent risk management focuses on avoiding individual risks, which results in the primary goal of keeping the sum of all potential risks as low as possible. The risk management measures are closely linked to ISO 31000 in terms of content. ISO 31000 provides normative guidelines on how organizations can implement professional risk management. The internationally active organization OECD (Organisation for Economic Cooperation and Development) describes ISO 31000 as the de facto world standard for risk management. Since risks are often linked to IT structures of companies, the latest version of the established ITIL® framework (ITIL® 4) includes the practice of "risk management".

You can find everything you need to know about OMNITRACKER Risk Management in a nutshell in our factsheet.

Benefits of a software-supported risk management

In addition to the primary goal of avoiding and mitigating risks, you benefit from the following direct and indirect advantages:

- You keep the effects (e.g. loss of time, money and image) of negative events as low as possible. In this way, you secure the long-term existence of your company and increase its value.

- You create more transparency at all levels (process, project, company) because you deal intensively with your process structures. You recognize potential improvements (opportunities) of your business processes, since you can systematically evaluate and optimize your workflows.

- You benefit from a better planning reliability and avoid resource bottlenecks. This leads to a long-term increase in profits.

- In some industries (e.g. banks and insurance companies), risk management software helps you to comply with industry-specific legal regulations. This includes the documentation of risk analysis, strategy and the implementation of predefined measures.

Minimize the effects of risks on your company and rely on a risk management software that can be individually adapted to your workflows. Our respective experts will be happy to support you with customizing services that are perfectly suited to your company and industry.

Your software solution in just 5 steps.

Send us an individual enquiry according to your needs.Satisfied OMNITRACKER users

OMNITRACKER makes processes clearer and easier.Cyclical approach to risk management realization

Risk management must be considered individually for each company, because the types of individual risks and how they are dealt with vary according to industry, communication structure and company size. Since the overall risk management process is very complex, it makes sense to divide it into the following sub-processes that can be standardized and easily implemented. The individual steps are then reliably carried out with the support of the risk management software:

In this first step, collect all individual risks (e.g. by using a ticketing tool), but do not yet evaluate or categorize these events. This is merely an unsorted, uncategorized listing. Each individual risk is linked to existing assets. Assets are, for example, hardware, software, licenses, contracts, buildings, employees, machines, processes etc. To obtain the most comprehensive portfolio of influencing potential factors, you should consider all of the following types of impact:

- Finances (damage/loss or potential for saving resources)

- Reputation (threats or opportunities in relation to the reputation of your company)

- Projects (events that endanger or favor the successful completion of a project)

- Health & environment (legal requirements and protection of your employees)

Analyze the individual risks listed in step 1 according to at least these criteria:

- Estimated impact on your company and on the achievement of your goals (e.g. amount of financial loss, impact on the successful progress of a project, loss of reputation, health risks to your employees).

- Estimated or calculated probability of occurrence of the event (e.g. rare, unlikely, possible, likely, fairly certain). How often has a comparable event occurred in the last year, the last three, five or ten years?

- Classification into defined risk categories: The risk landscape, i.e. the total of all individual risks, is unique for each company. Consequently, the risk categories into which the individual risks are classified also vary depending on the size and form of the organization and its industry. A few categories (such as fire protection or HR) are present in almost all organizations. Categories can be further subdivided into different levels, i.e. scaled.

The allocation to individual categories results into specific responsibilities for each individual risk. Once the probability of occurrence and the extent of damage have finally been determined, the responsible person determines which risk strategy is to be pursued for each individual risk (see step 4).

Important: When examining individual risks and their structure, you will also identify opportunities for improvement and resource saving. For this reason, analyze all the influencing factors listed, even if at first glance you consider their negative influences to be harmless, improbable or irrelevant.

By using the authorized information from step 2, form a grid with the probability of occurrence on one axis and the potential impact on achieving your goals on the other axis. Use this risk matrix to derive the priorities of your risk plan. Start with the risks which cause the greatest potential damage or have the greatest probability of occurrence—and move on to the less likely and less harmful risks. As part of our customizing process, we create a tailor-made, clickable risk matrix, which gives you a simple overview of your risk assessments.

In order to make optimum use of the risk matrix, you define criteria for which individual risks you execute concrete risk strategies and for which you do not. For example, you determine that you always take care of the five individual risks with the highest priority, and, at the same time, you take care of all risks with a potential damage exceeding 100,000 euros.

An efficient implementation and control of the individual and overall processes of all risks can only be achieved with a precisely defined plan of measures and time schedule for these strategies. The risk management software ensures the execution. A breakdown into the following risk strategy types is common:

- Risk avoidance: Reducing the probability of occurrence by discontinuing risky processes or replacing them with less risky processes

- Risk reduction: Minimize the extent of damage

- Risk transfer: Outsourcing risks, e.g. by means of insurance in the event of damage

- Risk acceptance: Accepting risks if, for example, the probability is extremely low or, in the case of occurrence, the damage is small and therefore acceptable

Analyze the success of all sub-steps and regularly adapt your catalog of measures and risk strategies to the general conditions or to your internal processes. If necessary, also vary the methods you use to collect and evaluate your risks. The more standardized your risk management processes are, the better their quality and efficiency will be.

After implementing a risk strategy, the corresponding individual risk must be analyzed again and finally evaluated (step 2). This is the only way to evaluate the success of your implemented measures. As part of professional quality management, you should document the goals of your measures and compare them with the results actually achieved.

- An employee recognizes a risk in the company, e.g. a workflow that is error-prone.

- This employee creates a ticket and thus draws attention to this danger.

- The employee estimates the probability of occurrence, the potential extent of damage and categorizes the risk.

- The responsible person for this category now makes a final assessment of the risk and determines how it should be dealt with.

- A risk strategy is selected and implemented according to priority. Appropriate measures are initiated as required.

- If concrete strategies are executed, their success is (regularly) evaluated and the risk is analyzed and assessed again.

The large amounts of data that have to be handled in the mentioned sub-steps can only be managed with an intelligent software solution. The more complex the data and communication structures of a company are, the more important individual customizing and a central database become. Partially automated workflows also ensure that you do not forget any action steps during regular analysis, evaluation, monitoring and implementation.

An alarming system that uses certain criteria to detect discrepancies from the standard process is also useful. Such escalations require action plans that are run through in case of emergency.

OMNITRACKER Risk Management | All functions & features

With OMNITRACKER Risk Management you collect risks, evaluate risks and cover all workflow-based processes company-wide uniformly. You benefit from the following functions:

- Structured evaluation of risks with freely definable risk categories

- Definition of measures

- Automatic monitoring of schedules for measures

- Automation of workflows in risk management using BPMN 2.0

- Easy-to-understand and expandable risk catalog

- Creating of a documentation (often required by law) with a history that cannot be manipulated

- Adaptable rights and roles concept with clear responsibilities for each phase within the risk management process

- Extensive customizing possible at all levels

- Support of the risk management requirements of ISO 31000 and ITIL®4

With OMNITRACKER the company IT operates with greater efficiency and we are achieving higher levels of user satisfaction.

Michael Fey, Head of IT

An outstanding and superior service is essential for our customers. OMNITRACKER supports us in achieving this via the registration and follow-up of customer enquiries.

Alexander Zwart, Head Cash Management Operations

A complex web-based contract management solution has been created with OMNITRACKER through constructive, direct and goal-oriented communication with the support of the competent OMNINET consultants.

Frank Merkel

Thanks to OMNITRACKER, we have been able to introduce ITIL-based processes and increase the quality of our IT Services.

Michael Fey, Head of IT

We appreciate the very personal and uncomplicated contact with OMNINET as manufacturer of our OMNITRACKER installations. In addition, the highly flexible applications and the support of the competent OMNINET employees are a valuable factor for us.

Curt Eylers, Group IT

For many years, OMNITRACKER has been our central platform for integrated and highly automated business processes.

In addition to the ITSM processes with which we started, today we also use OMNITRACKER to handle the majority of our administrative, logistics and compliance processes.

With OMNITRACKER ITSM Center we have taken a significant step forward on our way from grown structures to integrated Enterprise Service Management and thus to improving customer satisfaction.

Michael Niekut, Head of Service Operations Center

With OMNITRACKER we have the freedom to implement and adapt our processes by ourselves without having to rely on external support. The simple and seamless connection to third-party systems, such as our own TGW service portal, optimally supports our processes.

Stefan Hamann, Head of Application Services

OMNITRACKER provides us the opportunity to adapt all applications to our specific requirements with low configuration effort and it also guarantees release compatibility.

Moreover, we enjoy working with OMNINET's friendly and dedicated team.

The OMNITRACKER meets our most important requirements on BPM:

stability, flexibility, connectivity and transparency.

Complemented by professional consulting and friendly customer service, the result is a purposeful symbiosis of man and technology.

Expand your risk management with OMNITRACKER GRC Center

From a certain complexity and severity of the requirements for your organization, it makes sense to implement the areas of governance and compliance with software in addition to risk management. Due to the overlap in content and the interaction of the individual areas, it makes sense to rely on an integrated GRC solution for software-supported implementation. This allows you to monitor your existing processes, structures, corporate values and IT infrastructure in the best possible way, and optimize them with regard to all GRC aspects. The OMNITRACKER Governance, Risk and Compliance Center acts as an integrated platform that combines several management and control systems.

The role of risk management in modern software ecosystems

A risk management software only works efficiently if the underlying database is well-structured and the interaction with all areas of the company (IT and non-IT) runs smoothly. This is only possible with lean, targeted workflows, dynamic interfaces and an optimal data infrastructure. With the Business Process Ecosystem OMNITRACKER, all applications are perfectly coordinated, which significantly improves both planning and controlling processes in the field of risk management.

For example, IT service management helps to quickly eliminate existing incidents and keep their effects as low as possible. The structured evaluation of all incidents and service requests is the basis for taking efficient measures to avoid risks on a small scale or to keep their effects in total as low as possible. A ticketing system also supports you in recording or collecting risk reports.

Risks can endanger the successful completion of projects. Therefore, it makes sense to perform software-based risk assessments before and during projects. In modern software ecosystems—such as the Business Process Ecosystem OMNITRACKER—all digital information structures are linked together and access the same database. This leads to smooth workflows, a lower error rate and more planning reliability. OMNITRACKER Risk Management is compatible with the OMNITRACKER Project Management Center as well as with all other OMNITRACKER applications. Our project management software meets all relevant standards and is PRINCE2 certified.

Modern BPMN processes indirectly contribute to better identifying risks within sub-steps of processes and then eliminating them. By modelling business processes (as preparation for later automation), a company takes a close look at its process structure. This leads to more transparency, which in turn helps to identify weaknesses (i.e. risk factors) within workflows. Risk measures are automated and executed error-free with BPMN, which saves resources and minimizes the risk of application errors.